WELCOME TO A NEW WORLD FOR YOUR FINANCES

CREATING POTENTIAL TO BOOST

C1T TRAILER

TREASURYXX HFT

PRIVATE NEOBANK

Capital One Treasury is a private Neobank, headquartered in Panama, regulated by Panama and El Salvador to manage, custody, and process payments with Digital Assets internationally.

REAL-TIME DASHBOARD WITH INFORMATION

Use this tool to manage your fintech business in real-time and visualize card details, transactions, KPIs, and more.

GLOBAL PAYMENTS

Accepts cross-border payments and makes instant global payments through a single APP.

Forget about cash and step into the digital era, monetize your digital dollars, make physical and digital purchases in over 200 countries with fiat or crypto.

VISA & MASTERCARD PREMIUM CARDS

REMITTANCES

Send your remittances completely online or at physical locations through a secure and fast system.

ARBITRAGE TRUST

Safe exchange between FIAT and USDT

An investment program designed for your prosperity and security equipped with the latest HFT technology.

TREASURYXX

Our services

We specialize in comprehensive financial services in foreign exchange, banking, payments and processing.

We are the service center for our clients who need access to top-tier banks, e-money institutions, asset managers, foreign exchange brokers, card program managers, payment gateways, global crypto-asset services and private banks. With a cumulative 50 years of industry experience, our principals understand both client needs and market dynamics. We simplify the process of identifying and structuring the perfect solution for our clients.

Financial Services

We are a trusted partner for organizations and individuals around the world, providing support in a variety of business sectors and jurisdictions, enabling us to offer tailor-made solutions in sectors and geographies such as Europe, Latin and North America, the Caribbean, Asia, the Middle East and Africa.

Exclusive Multinational Trust, integrating Fiat / Crypto solutions

Virtual and segregated IBANs

API Integrations

Omnibus account access

Competitive exchange rates

Easy-to-use platforms & real-time reporting

Payments to third parties

Crypto - Objectives

Cross-border payment services play a key role in facilitating trade and financial transactions on a global scale and are essential to our services. These services enable individuals, businesses and institutions to transfer funds across international borders smoothly and efficiently, overcoming geographic and currency barriers.

By leveraging advanced technologies and networks, such as blockchain, SWIFT and various digital platforms, our services ensure secure, fast and cost-effective money movement while adhering to regulatory and compliance standards.

Crypto Services

Seamless activation and deactivation,

Compatible with all major currencies,

Wholesale liquidity,

Facilitating cross-border movements,

Multiple geographic presence,

Cryptocurrency processing,

Ability to deposit cryptocurrency-related funds in major currencies,

Support for third party payments,

Competitive fees,

Instant settlement,

Creation of our own Cryptocurrency ¨Source Treasury Gold¨ & ¨Li-Therium¨,

Crypto License in CZ - Republic.

Card Processing and Issuance

We, through our partners, provide a comprehensive payment platform that offers payment card issuance and crypto wallets.

In particular, the platform offers high deposit limits, easy fund transfers, multi-currency support and supports multiple cards and bank accounts per user.

We offer a worldwide network of payment gateways and partner acquiring banks, providing customized payment processing services in all jurisdictions.

Secure credit/debit cards: Visa and MasterCard for worldwide use.

Premium Credit / Debit Cards - Exclusive Invitation

Offers high credit/deposit limits

Charges in Crypto / Fiat / other types

VISA / MASTER CARD

Visa Premium Cards

Mastercard Corporate Premium

White-Label cards for companies such as:

¨GAME ING¨

¨BETS¨ in Colombia, Mexico, Brazil, Panama. (Betplay Type)

Payment processing for companies with Webcam Service in USA, Mexico, Panama, Colombia.

Payment processing for ¨Adult Services¨ companies.

OPERATING PLATFORM

LOANS

Payroll microcredit operations (PDL = Pay-Day Loan) (Colombia, Mexico).

FACTORING

Invoice purchase with full processing incl. Crypto (Panama, Colombia, Mexico).

REMITTANCES AND TRANSFERS

National and International Remittances between: Colombia, Mexico, Panama, USA, Canada, Ecuador.

STRUCTURE

The structure to process everything physically exists through our Superpagos partners in Mexico (DF), Panama and Colombia.

This is the integration of our new technology into the platform.

The operations center will be expanded and headquartered in Panama City.

PREMIUM PARTNERS

FEEL THE HFT POWER

Don't follow the market. Anticipate it.

Dominate the markets with cutting-edge technology. TreasuryXX takes investing to the next level with High-Frequency Trading (HFT) strategies designed to maximize every opportunity in milliseconds.

Access advanced strategies, ultra-fast execution and an infrastructure designed for success

Optimized algorithms for precise execution in microseconds.

Direct access to global markets with minimal latency.

Artificial intelligence models to maximize opportunities.

Exclusive access to institutional HFT strategies.

Optimized liquidity and real-time order execution.

Security and compliance with the highest regulatory standards.

Intuitive platform for real-time monitoring.

Exclusive access to institutional strategies.

How TreasuryXX: HFT Technology in the Service of Investing Works

TreasuryXX employs a High-Frequency Trading (HFT) approach based on state-of-the-art technology to optimize each execution and maximize capital efficiency.

Low Latency Infrastructure

Our trading architecture is designed to minimize latency, ensuring that each order is executed in microseconds. This is achieved by:

Placement of servers in proximity to exchanges to minimize response times.

Fiber optic networks and direct connections to the main global markets.

Algorithmic optimization to reduce slippage and improve execution efficiency.

Advanced Trading Algorithms

TreasuryXX integrates state-of-the-art algorithmic models that analyze the market in real time and make automated decisions with pinpoint accuracy. These include:

Market-Making: Liquidity provision and price spread capture.

Statistical Arbitrage: Identification and execution of arbitrage opportunities in fractions of a second.

Momentum Trading: Algorithms that detect and take advantage of short-term trends before the market reacts.

Machine Learning and Big Data in Market Analysis

TreasuryXX incorporates artificial intelligence to continuously adapt and improve its strategies:

Predictive models based on analysis of large volumes of data.

Backtesting and continuous optimization to refine parameters and minimize risks.

Detection of hidden patterns in order flow and market microstructures.

Security and Regulatory Compliance

TreasuryXX's trading environment operates under strict regulatory standards, ensuring:

Audited strategies in compliance with international standards.

End-to-end encryption of all transactions.

Real-time monitoring to prevent risks and ensure operational stability.

Investment for the bar raisers. TreasuryXX, where success has no limits.

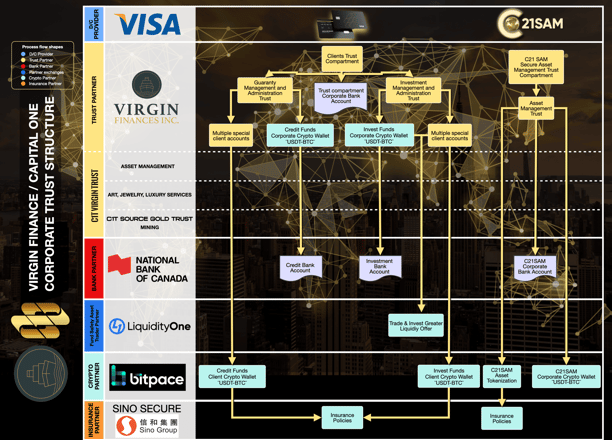

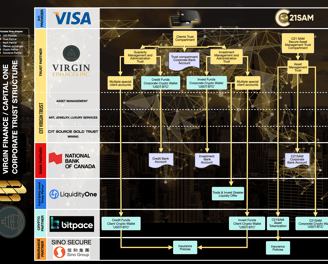

Capital One, in order to develop the objectives proposed for its Debit/Credit Card Management and Asset Management businesses, has built a corporate structure that meets the needs of security, ease and profitability of its clients.

Trust - Banking - Crypto Administration

Capital One has fiduciary agreements in force with Virgin Finances Inc. to manage the two forms of credit/debit and investment customer relationships, through the creation of two fiduciary compartments, one for the management of funds deposited as credit collateral, and the other for the management of funds deposited under administration for customer investment.

Each compartment generates individual fiduciary management sub-accounts for each client that are linked to both credit/debit lines and investment lines.These management sub-accounts reflect the funds deposited and converted into digital assets (USDTs) in individual client Crypto Wallets, issued on the Bitpace platform; where each client, can consult at will the balance of their credits/debits and investment.

Meanwhile, the general trust is a Single and Exclusive Compartment, which has both corporate Crypto Wallets, which reflect the movement of Visa purchase/sale transactions and investment and profitability of the financial portfolios of the business and trust accounts of assets in Fiat Currency (USD, EUR, etc).

Likewise, both the general trust and the corporate Crypto Wallets have corporate bank accounts, within the National Bank of Canada, where the Fiat Currency funds (USD, EUR, etc) of the business are reflected.

Risk management

There is the option of exchanging assets through a trading desk (Liquidityone), which guarantees a totally secure and guaranteed closing of operations.

The entire corporate structure has risk insurance for the proper management of assets issued by SinoSecure in favor of each client and each compartment, both for funds deposited as collateral for credit/debit and investment.

General Structure

The overall structure is comprised of contracts and business partnerships between service providers (VISA and C21SAM) and asset managers (Virgin Finances), banks (National Bank of Canada), Crypto Asset managers (Bitpace) and Risk Managers (Sino Secure); with the purpose of meeting the profitability objectives of Capital One and its clients.

Capital One Treasury Liquidity provides market access to the world’s leading crypto trading and liquidity venues through a single, integrated platform.

At Capital One Treasury Liquidity, we understand the importance of asset security in todays trading landscape. Our primary commitment is ensuring the absolute safety of client funds, a promise reinforced by our decision to never hold funds on exchanges.

State-of-the-art Infrastructure

Our unique setup ensures maximum uptime, minimizing potential disruptions.

In the evolving landscape of digital assets, we stand distinct as a Riskless Principal, transcending the ‘custody at exchange’ model.

Client funds held off-exchange with secure custody partners.

Optimal capital efficiency.

Access to multiple CEXs without funds on each LP.

Segregated clients’ funds. No comingling! Insured.

Seamless trading across multiple exchanges.

We equip our strategic partners – the clients – with state-of-the-art technology, risk mitigation strategies, deep liquidity, round-the-clock market access, and personalized support. This ensures they can initiate or expand their digital asset ventures with utmost confidence and security. Safety isn’t just a feature for us; it’s the very core of our business.

Secure, Seamless, Superior: Capital One Treasury Liquidity’s Promise of Uncompromised Fund Safety.

Seamless Access to Global Liquidity

Trade with Intelligent Order Routing

Optimal Crypto Prices

Dramatically Reduced Slippage

Operational & Capital Efficiency

One Wallet | One Account | Global Liquidity

Your Funds are Never held on Exchange

Industry-leading infrastructure for businesses to access, trade, and manage a diverse range of crypto assets.

C1T Liquidity is compliant by design and built to be the Gold Standard in cryptocurrency trading, globally.

Solid fundamentals and strong regulatory oversight.

Built in-line with traditional regulatory standards such as MiFID & Dodd Frank.

Independent governance over client assets under custody.

Robust AML, conduct and prudential risk management controls.

In a world where crypto trading is evolving rapidly, our project is here to revolutionize your trading experience. Imagine a platform that offers unmatched liquidity, transparent execution, and cost-effective trading—all while ensuring security and compliance.

With advanced tools and modern APIs, you can trade discreetly, manage risk efficiently, and access real-time market data. Say goodbye to multiple accounts and hello to a single entry point for all your trading needs.

NEOBANK PRIVATE SECTION

Access by invitation only.

Contact

trust.virginfin@c1t.ch Cham@c1g.group

Capital One Treasury© 2025. All rights reserved.

+1 (450) 231-2900 +1 (514) 400-6955

1000 de la Gauchetiere Ouest,

Bureau 3700,

Montreal, Quebec, Canada

Head office